Today, the promotional partnership is one of the most powerful sales channels, which has grown nearly five times for the last decade. From $2.9 billion in 2013 to $15.7 billion in 2024. Estimates show, that there are over 9000 affiliate related services/companies worldwide, including agencies, platforms, and other affiliate organizations.

Over 80% of companies who use advertising for product promotion use promotional partnership. The promotional partnership channel has proven its efficacy on every step of the shopping journey. Almost 83% use the influential power of the affiliates during the initial phase of product discovery and awareness, 79% utilize it during conversion or purchase and 79% use affiliates for more customer engagement.

What is affiliate networking

Think of promotional partnership as a modern-day referral system. Instead of traditional word-of-mouth referrals, affiliates utilize online platforms to endorse products or services of other businesses. Through strategically placed links or promotional content, affiliates direct potential customers to the company's website. When these referrals result in a sale or lead, the affiliate earns a commission.

This approach allows individuals with diverse interests and audiences to monetize their online presence without the hassle of product creation or inventory management. It's a symbiotic relationship where both parties benefit: companies expand their customer base, while affiliates generate income by leveraging their online influence.

What are the key drivers of promotional partnership

The backbone of promotional partnership lies in several essential factors that propel its success. One crucial driver is the widespread reach of the internet, which provides a vast platform for affiliates to promote products or services to a global audience.

Additionally, the low barrier to entry allows individuals of varying backgrounds and expertise levels to participate in affiliate programs, fostering diversity and innovation in marketing approaches. Another key driver is the performance-based nature of promotional partnership, where affiliates are rewarded based on their actual contributions to sales or leads, ensuring a mutually beneficial relationship between companies and affiliates.

Moreover, the continuous evolution of digital technologies and marketing strategies constantly reshapes the landscape of promotional partnership, driving its growth and adaptability in the ever-changing online marketplace.

Why promotional partnership is beneficial for business

The appeal of promotional partnership to businesses lies in its ability to provide a measurable return on investment. By partnering with affiliates, businesses can access a vast network of promoters who are incentivized to drive results. Unlike traditional advertising methods, where companies pay upfront for exposure with uncertain outcomes, promotional partnership ensures that businesses only incur costs when desired actions, such as sales or leads, are achieved.

Moreover, the decentralized nature of promotional partnership allows businesses to tap into niche markets and audiences that may be otherwise difficult to reach through conventional advertising channels. This targeted approach not only maximizes the effectiveness of marketing efforts but also enhances brand credibility and trustworthiness among consumers.

What are best types of affiliate programs

When it comes to affiliate programs, there are several types that stand out as particularly effective. One of the top choices is the pay-per-sale model, where affiliates earn commissions for every sale they generate for the company. This model ensures that affiliates are motivated to drive quality traffic and maximize conversions.

Another popular type is the pay-per-click program, where affiliates earn a commission for every click generated through their referral links, regardless of whether it leads to a sale. This model is advantageous for companies looking to increase website traffic and visibility. Additionally, the recurring commission model, where affiliates earn commissions for ongoing purchases made by referred customers, provides a steady stream of income over time.

Ultimately, the best type of affiliate program depends on the goals and preferences of both the company and the affiliates involved.

In what sectors promotional partnership is mostly used

Taking a panoramic view of various sectors, Retail emerges as the frontrunner in revenue generation, commanding a significant portion of 44%. Following closely are Telecom and Media, constituting a noteworthy 25% of the revenue landscape, while Travel and Leisure secure their place with 16%. The residual 15% is distributed among several other sectors.

Affiliate network analysis

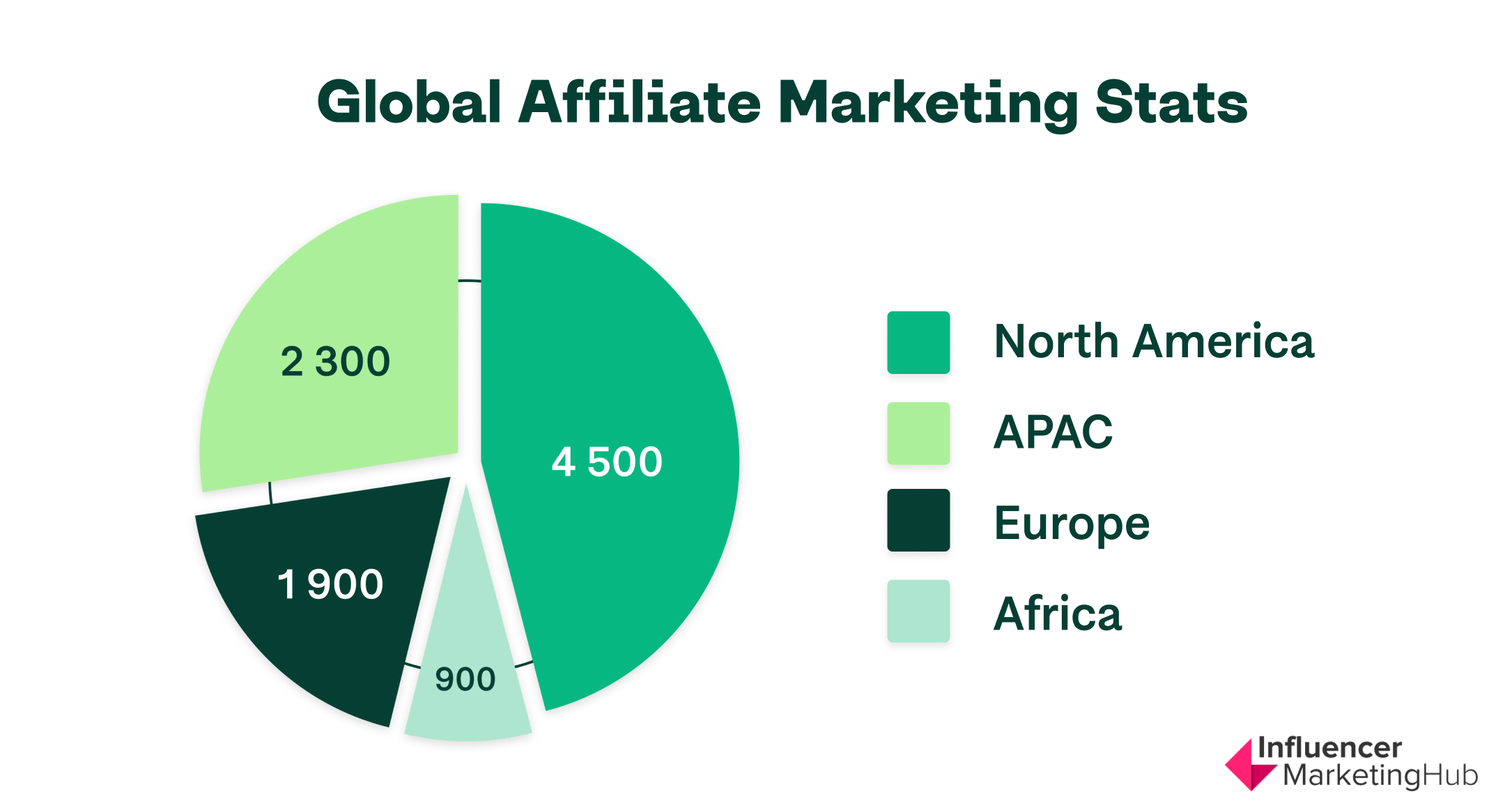

In the grand ballroom of promotional partnership, every region brings its unique steps, creating a global opportunity for every brand.

As of 2024, it's already valued at a staggering USD 18.5 billion, and forecasts indicate a consistent expansion at a 6.5% CAGR from 2024 all the way to 2031.

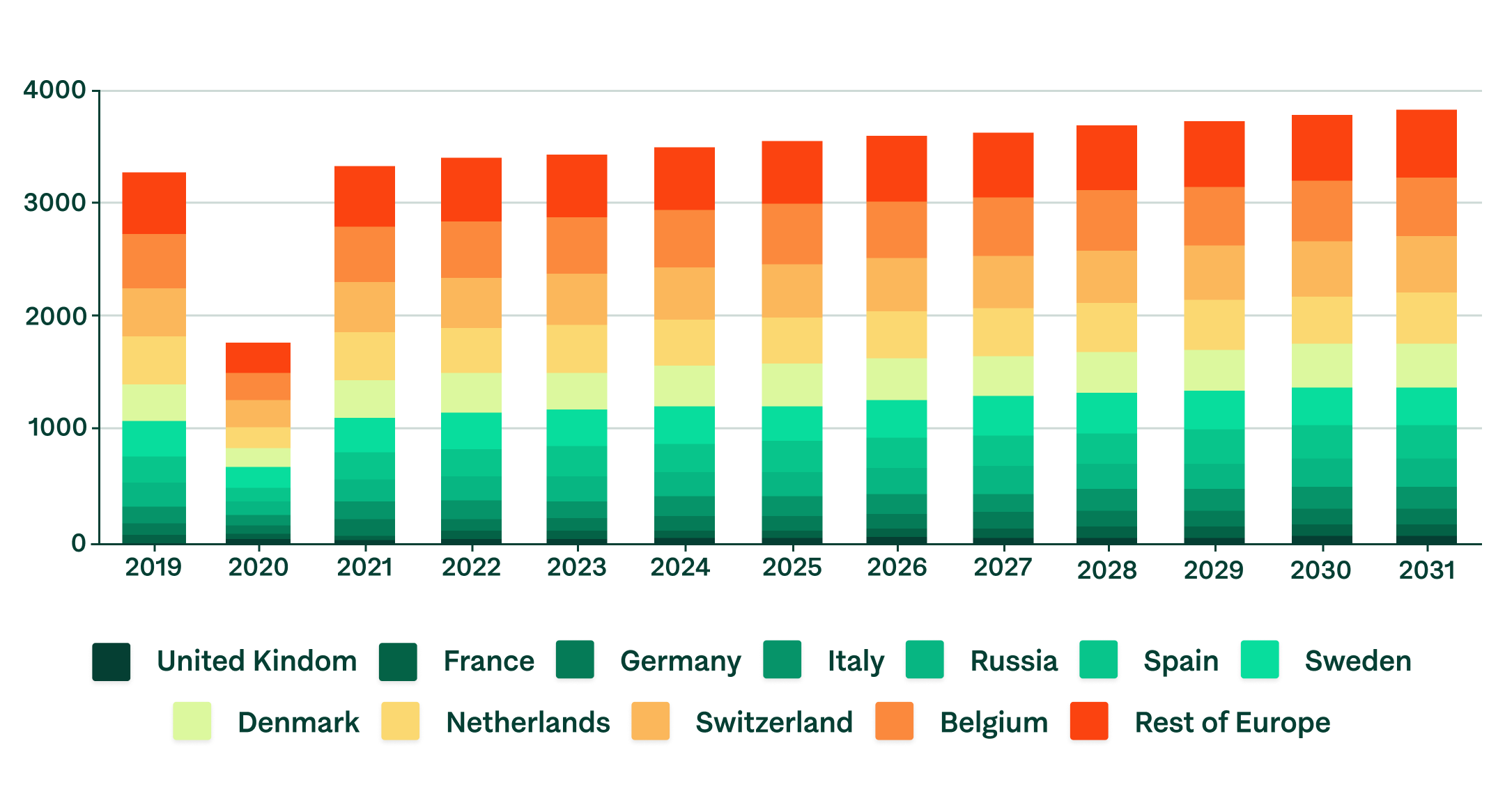

The affiliate landscape in Europe

Keep an eye on Europe's affiliate landscape — it's projected to reach an impressive $5.55 billion in sales, with a steady 6.5% yearly growth expected until 2030. It's worth noting that Europe's role in the global market of promotional partnership is crucial, representing more than 30% of its global size.

- United Kingdom (UK):

- In 2024, the UK market of promotional partnership boasted a substantial market share of USD 933.01 million. Projections indicate that it will continue to thrive, with an estimated 7.3% compound annual growth rate (CAGR) during the forecast period.

- The surge in UK Affiliate sales can be attributed to the nation’s vast population of online shoppers, who actively engage in promotional partnership programs.

- France:

- France’s market of promotional partnership is on the rise, projected to witness growth at a 5.7% CAGR during the forecast period.

- Its market size is anticipated to reach USD 510.94 million by 2024.

- Germany:

- In 2024, the German market of promotional partnership was valued at USD 1099.62 million.

- Expectations point to a 6.7% CAGR as the market continues to expand.

- Germany’s robust affiliate sales can be attributed to the presence of numerous affiliate networks within the country.

- Italy:

- Italy’s market of promotional partnership is poised for growth, projected to witness a 5.9% CAGR during the forecast period.

- By 2024, its market size is estimated to be USD 477.61 million.

- Russia:

- Russia’s market of promotional partnership is also on an upward trajectory, with a 5.5% CAGR expected during the forecast period.

- The market size is projected to reach USD 860.82 million by 2024.

- Spain:

- Spain’s market of promotional partnership is set to grow at a 5.6% CAGR.

- By 2024, its market size is anticipated to be USD 455.40 million.

- Luxembourg:

- Luxembourg’s market of promotional partnership is projected to witness growth at a 6.6% CAGR.

- Its market size is estimated to be USD 172.16 million in 2024.

- Portugal:

- Portugal’s market of promotional partnership is expected to grow steadily, with a 6.3% CAGR.

- By 2024, its market size is forecasted to be USD 116.63 million.

- Greece:

- Greece’s market of promotional partnership shows promise, projected to witness a 6.8% CAGR.

- Its market size is estimated to be USD 66.64 million in 2024.

- Rest of Europe:

- The broader European market of promotional partnership, excluding the aforementioned countries, is also on the rise.

- It is projected to grow at a 5.2% CAGR, with a market size of USD 860.82 million by 2024.

The thriving e-commerce landscape in Europe, coupled with evolving consumer preferences, fuels substantial growth in the affiliate sector. Europe’s diverse industry sectors and well-established digital marketing ecosystem create an ideal environment for affiliate collaborations. Among the driving forces is the demand for ethical and eco-friendly products. As consumers increasingly prioritize social responsibility and sustainability, affiliates leverage their platforms to endorse environmentally conscious companies and goods.

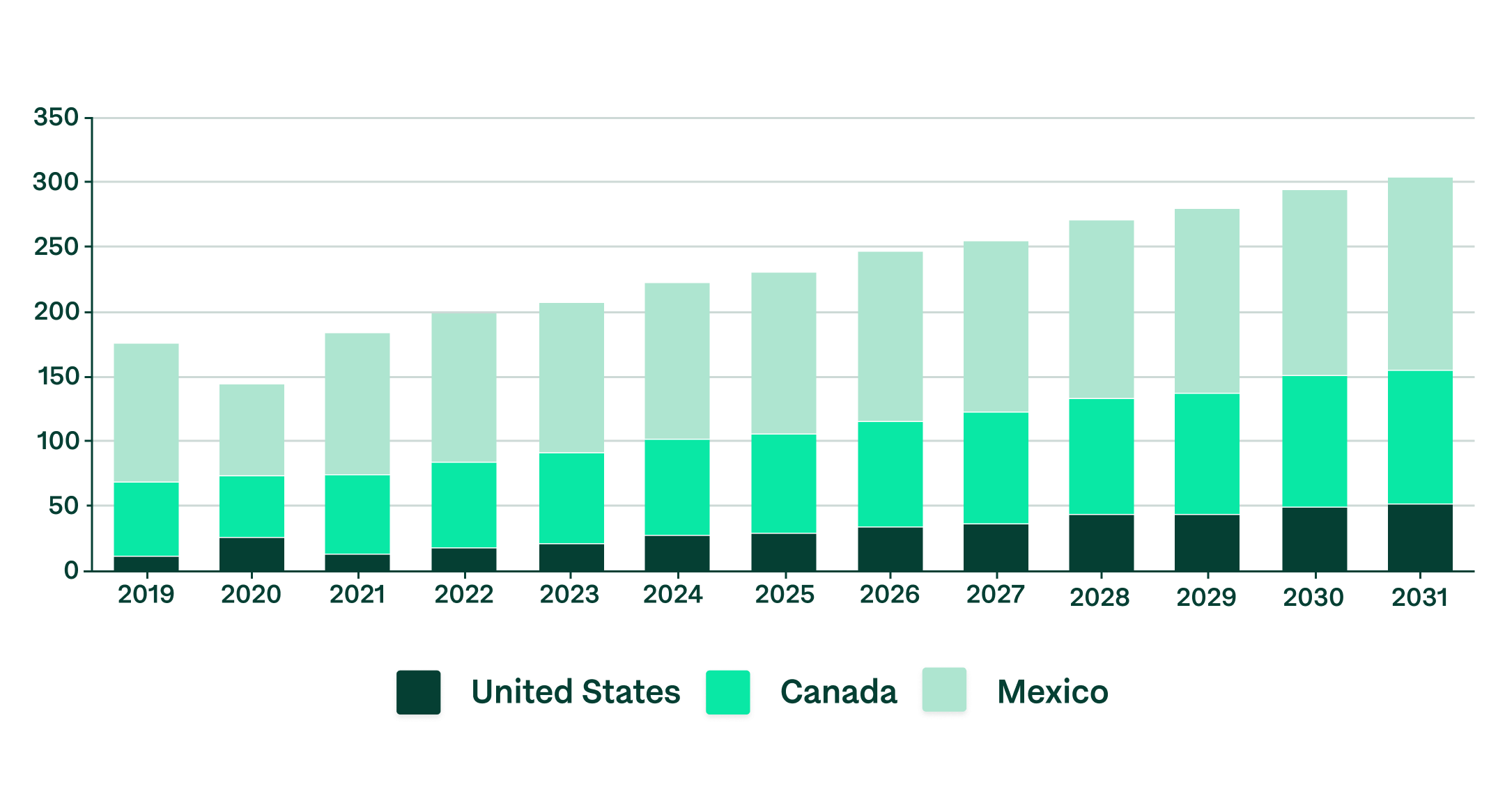

North America affiliate landscape

North America commands a significant share, contributing over 40% of global revenue. In 2024, its market size stood at USD 7.4 billion. Projections indicate a 6.2% compound annual growth rate (CAGR) from 2024 to 2031.

Country-specific analysis:

- United States (US):

- In 2024, the US dominated the market of promotional partnership, boasting a substantial market size of USD 5842.45 million.

- Projections suggest a 6.0% compound annual growth rate (CAGR) during the forecast period.

- The driving force behind this demand surge lies in the vibrant e-commerce industry thriving within the nation.

- Canada:

- Canada’s market of promotional partnership mirrors this upward trend, securing a market share of USD 888.59 million in 2024.

- Expectations point to a 7.0% CAGR, fueled by the country’s escalating internet penetration rates.

- Mexico:

- Mexico’s market of promotional partnership charts a promising course, projected to witness growth at a 6.7% CAGR.

- By 2024, its market size is estimated to reach USD 673.84 million.

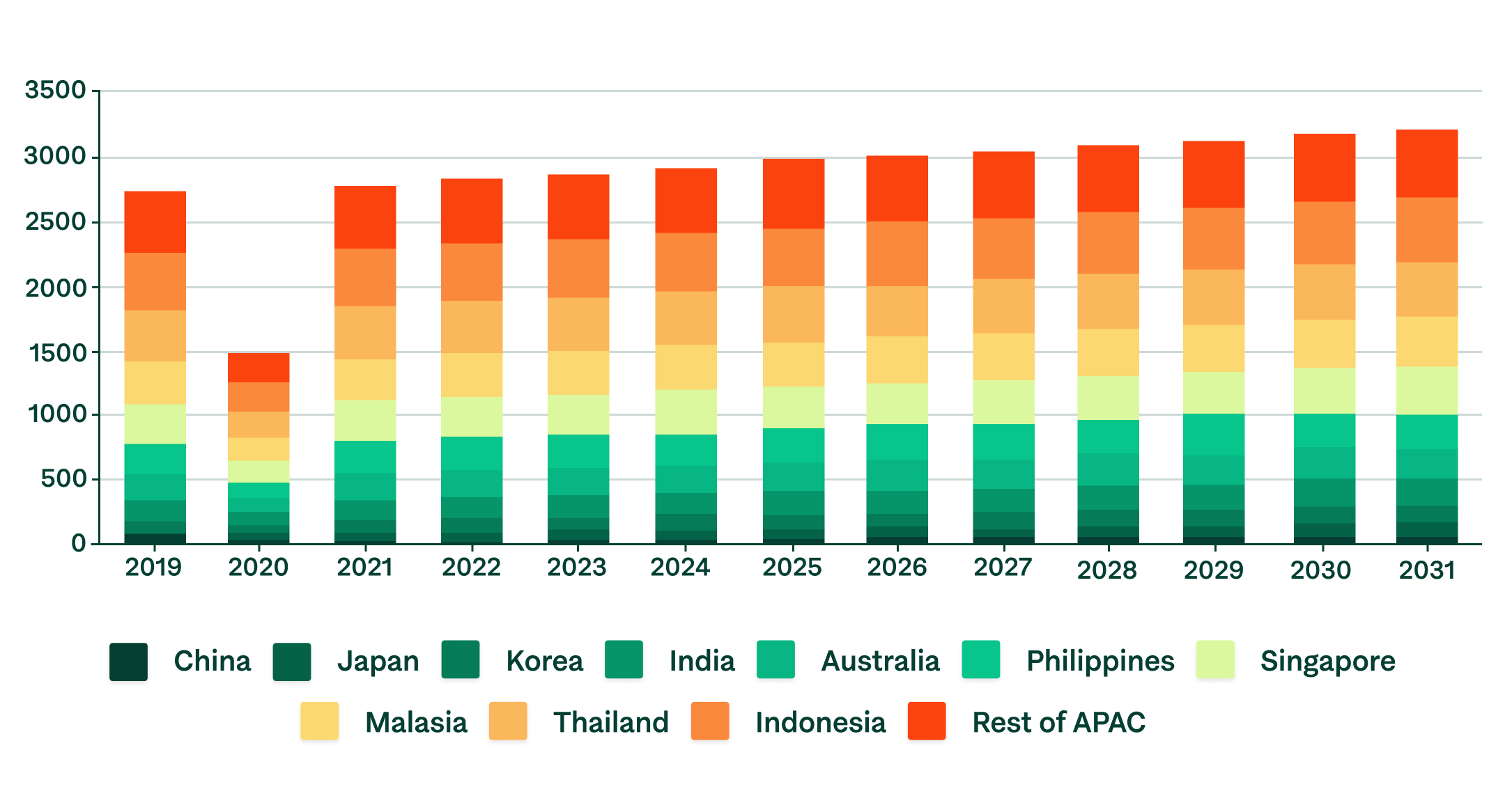

Asia Pacific affiliate landscape

Asia Pacific emerges as a pivotal player, commanding 23% of the global revenue with a market size of USD 4.257 billion. Projections indicate 10% compound annual growth rate (CAGR) from 2024 to 2031.

Asia’s market of promotional partnerships buzz with activity, each country weaving its unique narrative:

- South Korea:

- South Korea’s market of promotional partnership embarks on a growth trajectory, projected to witness a 9.1% CAGR.

- By 2024, its market size is anticipated to reach USD 425.78 million.

- Australia:

- Down Under, Australia’s market of promotional partnership thrives, projected to grow at a 9.7% CAGR.

- By 2024, its market size is forecasted to be USD 221.41 million.

- China:

- In 2024, the China market of promotional partnership stood at a commendable USD 1916.01 million.

- Projections indicate a robust 9.5% compound annual growth rate (CAGR) during the forecast period.

- The surge in affiliate sales within China can be attributed to the nation’s rapid expansion within a mature digital marketing ecosystem.

- Japan:

- Japan’s market of promotional partnership charts an exciting course, projected to witness growth at an 8.5% CAGR.

- By 2024, its market size is estimated to be USD 587.58 million.

- India:

- India’s market of promotional partnership showcases immense promise, boasting a market share of USD 510.94 million in 2024.

- Expectations point to an impressive 11.8% CAGR, fueled by the country’s rapidly expanding e-commerce sector.

- South East Asia:

- Projections indicate an impressive 11.0% CAGR, with a market size of USD 293.79 million by 2024.

- Rest of Asia Pacific’s:

- Expect a steady 9.0% CAGR, with a market size of USD 302.30 million in 2024.

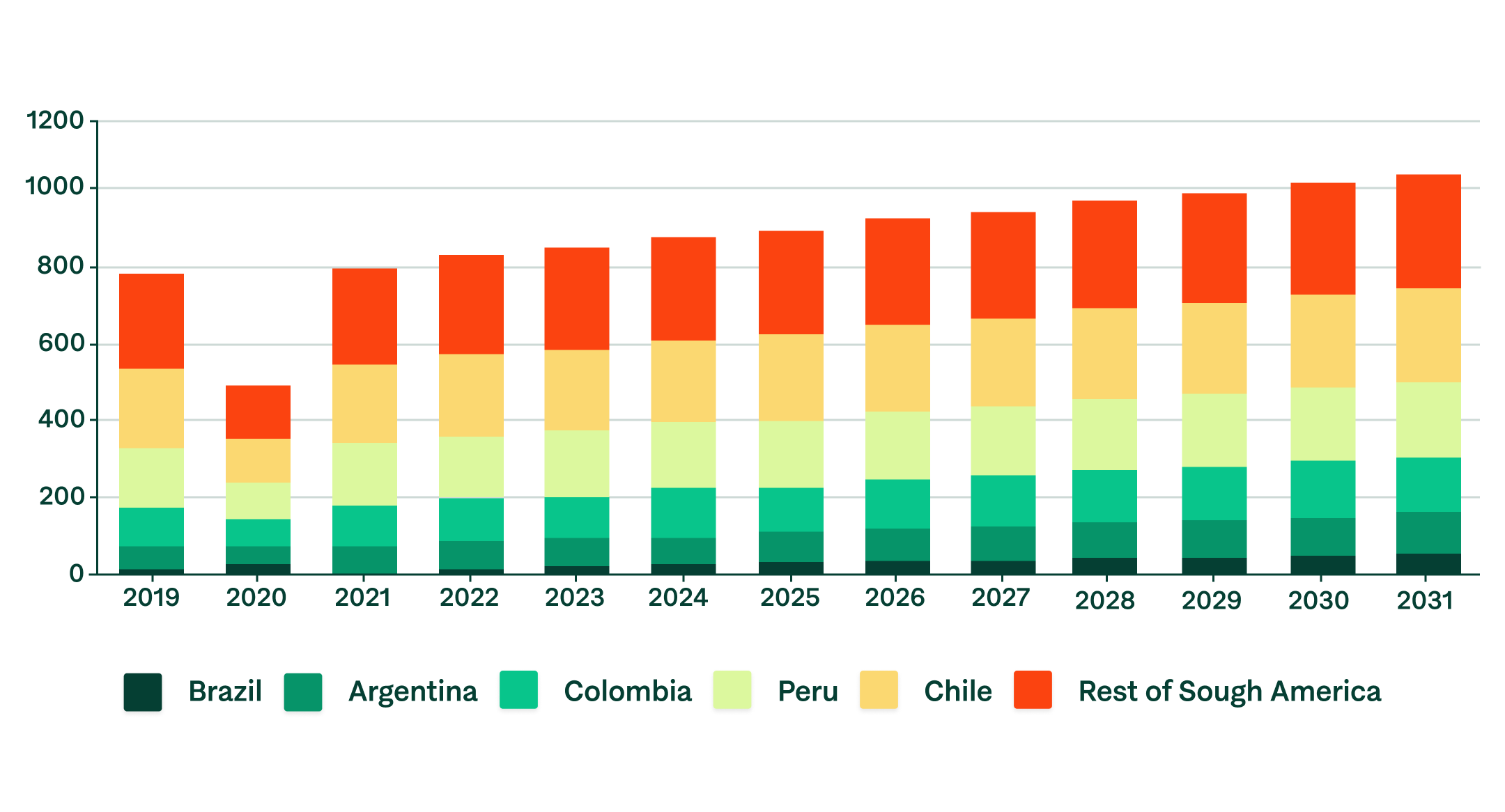

South America affiliate landscape

The Latin American market is a noteworthy player on the global stage, accounting for more than 5% of the total revenue, reaching a considerable size of USD 0.925 billion in 2024. Looking ahead, this market is anticipated to experience steady growth, with a projected compound annual growth rate (CAGR) of 7.4% from 2024 through 2031.

- Brazil:

- In 2024, Brazil’s market of promotional partnership boasts a valuation of USD 396.16 million.

- Projections indicate a robust 8.0% compound annual growth rate (CAGR) during the forecast period.

- The thriving digital economy in Brazil fuels the flourishing affiliate sales landscape.

- Argentina:

- Argentina’s market of promotional partnership stakes its claim with a market share of USD 155.50 million in 2024.

- Expectations point to an impressive 8.3% CAGR, driven by Argentina’s unwavering commitment to social media platforms.

- Colombia:

- Colombia’s market of promotional partnership charts a growth path, projected to witness a 7.2% CAGR.

- By 2024, its market size is anticipated to reach USD 82.38 million.

- Peru:

- Peru’s market of promotional partnership embraces growth, projected at a 7.6% CAGR.

- By 2024, its market size is forecasted to be USD 75.90 million.

- Chile:

- Chile’s market of promotional partnership dances to a rhythm of 7.7% CAGR during the forecast period.

- By 2024, its market size is poised at USD 66.64 million.

- Rest of Latin America:

- Beyond these spotlighted countries, the rest of Latin America contributes significantly.

- Expect steady progress with a 6.5% CAGR, resulting in a market size of USD 149.02 million in 2024.

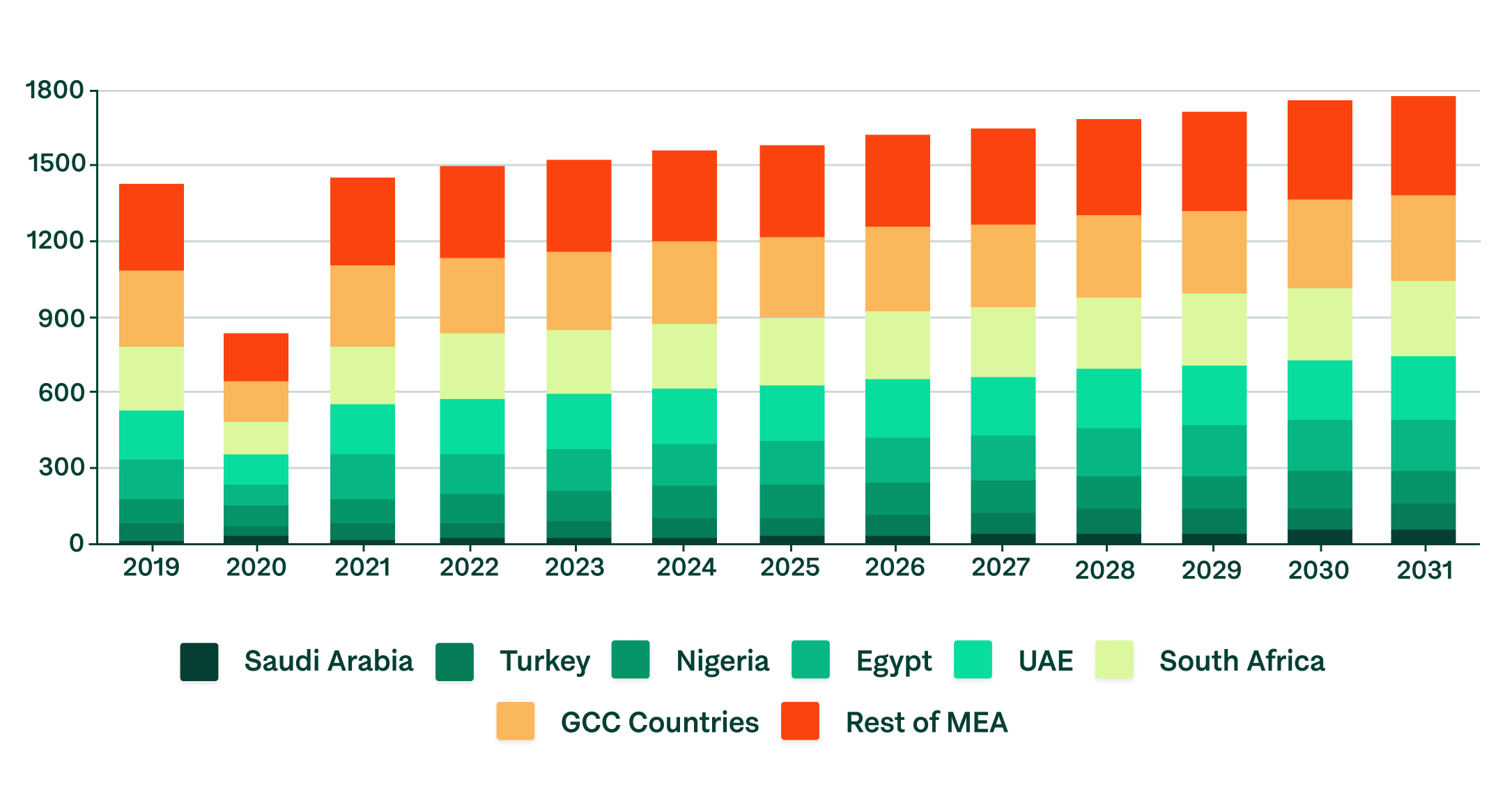

Middle East and Africa affiliate landscape

In 2024, the market of promotional partnership in the Middle East and Africa commanded a significant share of 2% globally, with a market size of USD 370.24 million. Projections indicate a robust 7.7% compound annual growth rate (CAGR) during the forecast period. This region’s dynamic growth is fueled by a mix of factors, including digital adoption, e-commerce expansion, and evolving consumer behavior.

- GCC countries (Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates):

- In 2024, the GCC Countries’ market of promotional partnership stakes its claim with a valuation of USD 158.46 million.

- Expectations point to an impressive 8.5% CAGR, fueled by the region’s robust consumer spending.

- Egypt’s Digital Ascent:

- Egypt’s market of promotional partnership charts an intriguing course, projected to witness a steady 8.0% CAGR.

- By 2024, its market size is anticipated to reach USD 38.88 million.

- South Africa:

- South Africa’s market of promotional partnership dances to a rhythm of 8.7% CAGR during the forecast period.

- By 2024, its market size stands at USD 58.50 million.

- Turkey:

- Turkey’s market of promotional partnership embarks on a growth trajectory, projected at a 7.2% CAGR.

- By 2024, its market size is forecasted to be USD 31.84 million.

- Nigeria:

- Nigeria’s market of promotional partnership embraces growth, projected at a 6.8% CAGR.

- By 2024, its market size is poised at USD 38.88 million.

- MEA countries:

- Beyond these spotlighted countries, the rest of MEA contributes significantly.

- Expect steady progress with a 6.7% CAGR, resulting in a market size of USD 43.69 million in 2024.

Top affiliate networks

Top affiliate networks by connected affiliates

Largest affiliate networks by amount of connected affiliates are:

- Amazon Associates (over 900 000)

- ShareASale (over 700 000)

- Awin (over 250 000)

- Rakuten (over 150 000)

- ClickBank (over 100 000)

promotional partnership has long been synonymous with Amazon's supremacy, yet their reign faced a setback in 2020 with alterations to their payout structure, causing a decline in popularity. This adjustment saw significant reductions in commission rates across various categories. Notably, the commission for furniture and home improvement products plummeted from 8% to 3%, while for grocery items, it dipped from 5% to a mere 1%.

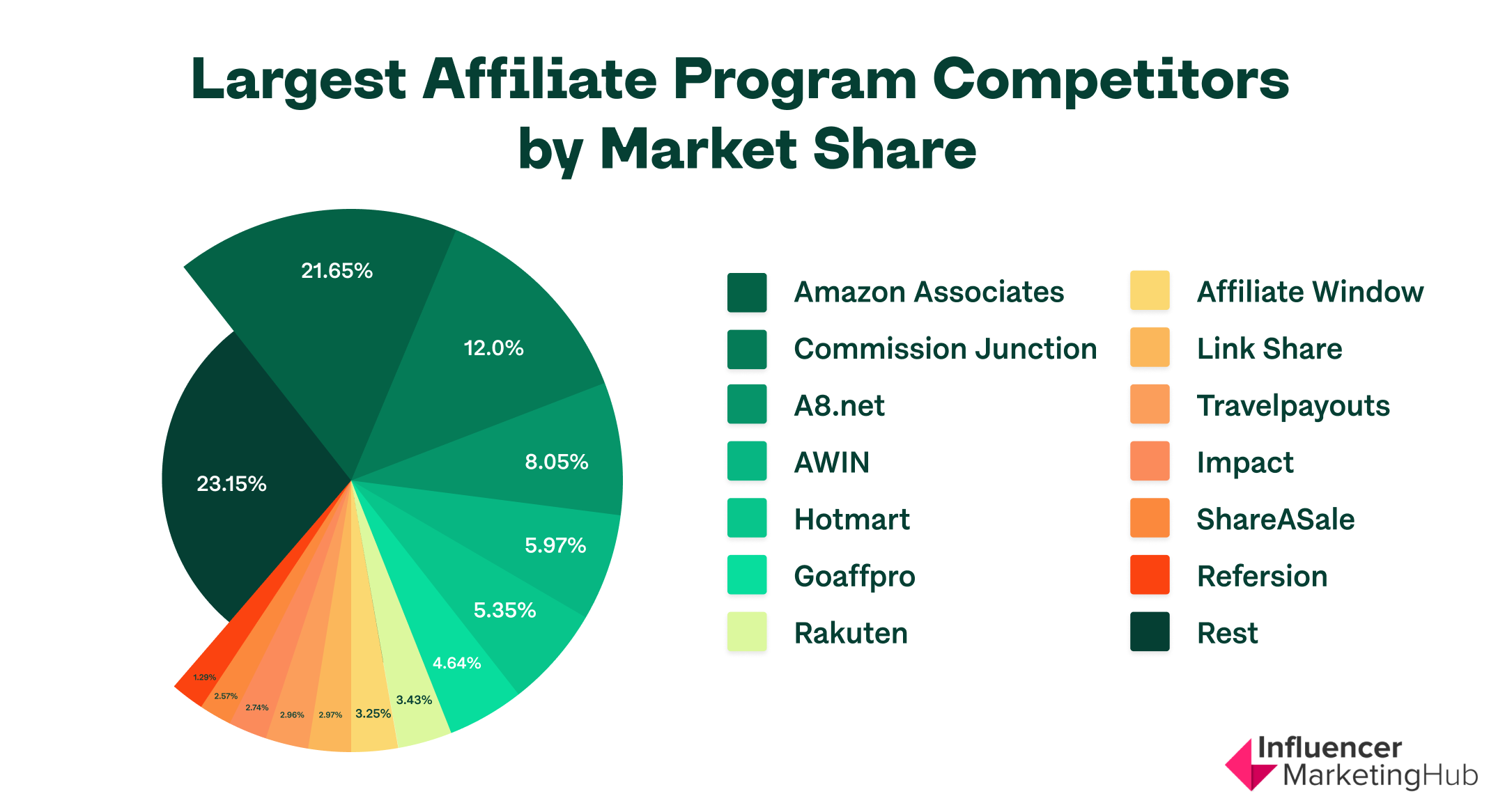

Top affiliate networks by market share

Amazon Associates reigns as the leading global affiliate program, capturing a substantial 21.65% share of the market of promotional partnership. Its closest contender, Commission Junction, trails behind with 12%, followed by A8.net at 8.05%, AWIN at 5.97%, Hotmart at 5%, and GoAffPro at 5%.

Despite ShareASale's notable popularity, evidenced in the preceding statistic, it boasts only 25,000 sites, accounting for 2.57% of the market, in stark contrast to Amazon Associates' extensive network of over 215,000 websites. This stark contrast stems largely from the differing business models employed by Amazon and ShareASale. While Amazon Associates concentrates solely on promoting Amazon products, ShareASale accommodates affiliate programs for over 4,500 merchants, ranging from major players to smaller entities. Its focus primarily revolves around key players in the US and Europe, thereby explaining the disparities in size and niche coverage.

Top affiliate networks by websites

Amazon Associates also keeps a top spot when the affiliate networks are sorted by the number of websites they are connected to. The list of top networks includes the following:

- Amazon Associates (over 215 000 websites)

- A8.net (over 129 000 websites)

- Comission Junction (over 80 000 websites)

- Awin (over 59 000 websites)

- Hotmart (over 53 000 websites)

- GoAffPro (over 45 000 websites)

- Rakuten (over 34 000 websites)

- Affiliate Window (over 32 000 websites)

- Link Share (over 29 000 websites)

- Travelpayouts (over 29 000 websites)

- Impact (over 27 000 websites)

- ShareAsale (over 25 000 websites)

- Refersion (over 12 000 websites)

Top-10 affiliate networks in details

Amazon Associates

Amazon Associates stands as a leading global platform in this sector that provides publishers, and creators with an opportunity to generate income by endorsing Amazon's diverse product lineup. The Amazon Associates Program has been evolving over the years and saw its official launch in 1996.

The program showcases an expansive range of products, spanning from electronics and clothing to books, kitchen appliances, beauty items, and more. Essentially, it includes nearly every category found on Amazon. Affiliates have access to easy-to-use tools that help them direct their audience towards particular product recommendations. Whether it's a bestseller, or a fashionable outfit, affiliates can promote these using their customized links.

Amazon Associates operates across numerous countries worldwide. Whether business resides in the US, India, Germany, Japan, or any other country where the program is available, it can join and get benefits from qualifying sales and customer engagements.

A8.net

A8.net emerges as a standout Japanese network, providing content creators like bloggers, site owners, and social media influencers with avenues to generate income from their online endeavors. Initially founded in 2000 to promote affiliate marketing, A8.net has been a strong advocate for this marketing strategy from its early stages. While the specific founding date remains undisclosed, its influence on affiliate marketing has been significant over the years.

A8.net offers a wide range of affiliate marketing choices, covering various sectors such as fashion, electronics, beauty, and lifestyle. Publishers within the A8.net community can choose from a rich assortment of ads to promote products that align with their audience's interests. Whether it is a blog, a website, or social media, A8.net opens doors to advertise relevant items.

Although A8.net's primary focus lies in Japan, it's recognized as the leading affiliate network with 25 382 advertisers who get help from 3 428 869 in promoting their products. By bridging the gap between advertisers, such as brands and businesses, and content creators, A8.net facilitates productive collaborations. Its influence, however, extends beyond Japan's borders, making it a noteworthy player on the global stage.

Comission Junction

Once known as Commission Junction, CJ has carved a niche for itself in the global performance marketing arena, especially with its affiliate marketing solutions. Established in 1998 in Santa Barbara, California, CJ has earned trust and recognition over time. Its primary goal is to support intelligent, versatile, and sustainable growth for businesses, publishers, and content creators around the world.

CJ's platform is diverse, catering to an extensive range of goods and services that include fashion, electronics, travel, and lifestyle products. It provides a user-friendly interface for advertisers and publishers to collaborate seamlessly. Brands can effectively present their offerings to the market, while publishers and influencers can connect with products and services that appeal to their followers.

With a global outreach, CJ connects partners across the globe. Its expansive network spans multiple countries, enabling advertisers and publishers to tap into a vast and varied audience. From North America to Europe, Asia, and beyond, CJ supports businesses in thriving across different markets.

Awin

Founded in 2000, Awin has become a major player in the affiliate marketing scene, linking advertisers and publishers worldwide, regardless of their magnitude.

Awin offers a broad selection of products across various industries:

- Retail & Shopping: This sector features online retailers, specialty shops, large department stores, and businesses in fashion, beauty, and technology.

- Fashion: Awin presents a diverse range of fashion brands, encompassing both traditional stores and online platforms.

- Travel: Awin's travel category is extensive, including options for hotels, flights, day activities, event tickets, and distinct experiences.

- Finance & Insurance: Awin caters to financial institutions, credit card issuers, insurance companies, and loan providers. Telco & Services: Awin works with telecom providers, broadband companies, mobile operators, and ticket sellers, to name a few.

With a presence in many countries worldwide, Awin furnishes a global stage for advertisers and publishers to establish online partnerships. Through customized strategies tailored to businesses of all sizes, Awin helps them enhance their digital footprint and realize their global marketing goals.

Hotmart

Hotmart stands out as an active center for sharing digital products. Created to make the digital content creation and marketing process smoother, it offers a platform for people to easily create and showcase their digital items. Besides hosting these products, Hotmart aids in promotional efforts, handles secure payments, and ensures that earnings are distributed fairly.

More than just a place to share digital goods, Hotmart encourages people to spread their knowledge globally and earn from their skills. Its broad presence across different countries, with diverse currencies and payment options, makes Hotmart a versatile tool for digital business owners everywhere.

GoAffPro

Since its debut in 2019, GoAffPro has become known as an accessible tool for website owners aiming to set up affiliate marketing initiatives quickly. Its increasing recognition is evident in the marketing sector.

The platform serves as a bridge between online stores and potential affiliate partners, encompassing both individual promoters and social media influencers. Online retailers can easily incorporate the GoAffPro app into their websites, presenting a broad selection of products including fashion, electronics, beauty, and home goods. Affiliates can enroll in merchant programs and receive special referral links to advertise these products. Through these referral links, affiliates can earn commissions based on the sales they help generate.

With its global reach, GoAffPro connects merchants and affiliates worldwide, spanning various regions and ensuring seamless connections between them.

Rakuten Affiliate

Having been in the industry for more than 20 years, Rakuten has risen to prominence as a key player in the international affiliate marketing field. Their expertise lies in linking brands to their target consumers through well-designed affiliate marketing approaches. The platform proudly collaborates with over 150,000 top-notch partners and has a team of more than 100 professionals dedicated to their success.

Rakuten's marketplace features a diverse selection of products across multiple sectors. Affiliates can showcase offerings from a broad spectrum of well-established advertisers, covering areas such as fashion, electronics, travel, and lifestyle.

Spanning across the globe, Rakuten operates in a multitude of countries with a robust team of over 100 experts on the ground. They play a crucial role in building and maintaining relationships with partners, enabling brands to penetrate new markets worldwide, from the United States to Japan and beyond.

Affiliate Window

Affiliate Window, an UK-based network, which is now part of Awin, has formed alliances with more than 2 100 advertisers and 75 000 publishers, spanning various sectors. Affiliate Window operates across various sectors, including retail, fashion, travel, finance, insurance, and telecommunications. Its impact extends beyond the UK, reaching multiple countries worldwide, including Germany, France, and the Netherlands.

Link Share

As part of Rakuten Advertising, LinkShare has carved a niche for itself in the affiliate marketing landscape by facilitating connections between advertisers and publishers in the performance marketing sector. Established in 1996, LinkShare has been instrumental in shaping the online shopping industry, establishing itself as an early leader in affiliate marketing.

The platform boasts a diverse portfolio of products and services available for promotion. Publishers and advertisers work together to advertise a variety of goods, ranging from e-commerce products and travel bookings to financial services, software solutions, fashion items, and electronics. Essentially, Rakuten LinkShare provides affiliates with a platform to highlight a multitude of products to their followers.

With its global reach, Rakuten LinkShare collaborates with advertisers and publishers across various countries. Its extensive network encompasses numerous regions, allowing affiliates to target audiences globally, be it in North America, Europe, Asia, or other parts of the world, promoting cross-border affiliate marketing relationships.

Travelpayouts

Since its inception in 2011, Travelpayouts has been designed as a pay-per-action platform specifically for travel bloggers keen on affiliate marketing.

It enables bloggers to earn income by promoting well-known travel brands to their audience. The platform makes it simple for bloggers to incorporate affiliate tools into their posts without needing coding expertise. Offering a broad range of over 100 reputable travel brands, Travelpayouts caters to various travel services.

From accommodations like hotels and apartments to health-focused stays at sanatoriums, Travelpayouts provides diverse options. With a global presence, it connects partners from different countries, establishing itself as a top pick for bloggers and marketers aiming to earn from their travel-related content.

Summarizing

The landscape of promotional partnership in 2024 showcases a thriving industry that continues to expand globally. With the market estimated at $15.7 billion, promotional partnership has become a powerhouse in driving sales and leads for businesses across various sectors. Over 80% of companies now leverage promotional partnership as an integral part of their advertising strategy, utilizing the influence of affiliates at every stage of the customer journey.

Europe, North America, Asia Pacific, South America, and the Middle East and Africa all contribute significantly to the market of promotional partnership, each region experiencing steady growth and offering unique opportunities for collaboration. Notable affiliate networks like Amazon Associates, ShareASale, and Awin continue to dominate, with Amazon Associates leading the pack in terms of connected affiliates, market share, and website connections.

Despite Amazon's recent commission rate adjustments, the promotional partnership ecosystem remains robust, driven by factors such as the widespread reach of the internet, low entry barriers, and the performance-based nature of affiliate programs. As the digital landscape evolves, promotional partnership is poised to continue its upward trajectory, providing a mutually beneficial relationship for businesses and affiliates alike.