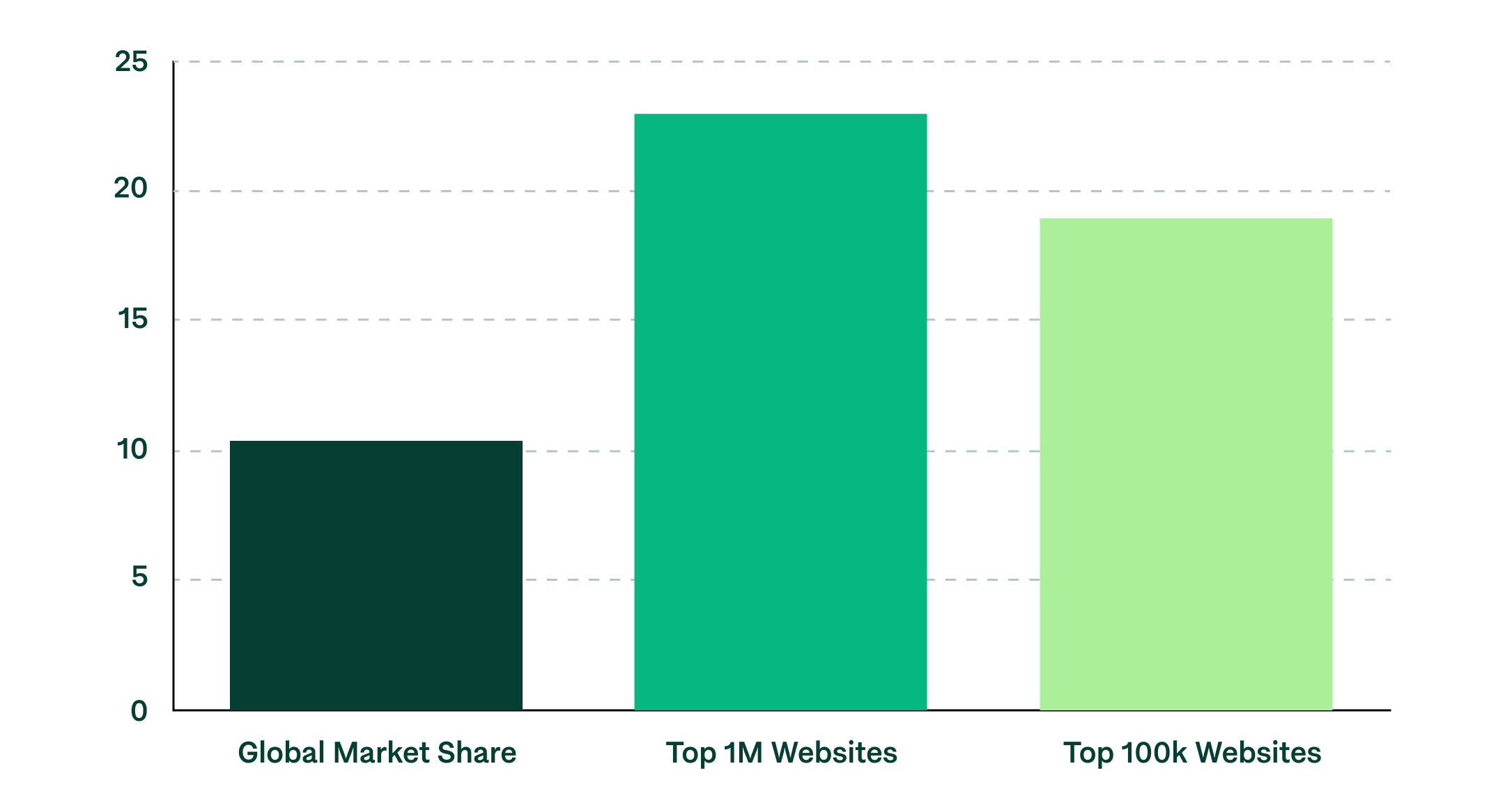

Shopify has established itself as a leading player in the global e-commerce sector, with over 4.5 million websites utilizing its platform worldwide. As of 2024, Shopify is ranked 4th among the top five eCommerce platforms, commanding a market share of 10.32%. Its influence is particularly notable among high-traffic sites, holding a 23% share in the top one million websites and a 19% share among the top 100 000 websites. This widespread adoption underscores Shopify's strong presence and reliability in the competitive world of online commerce.

Each day, Shopify sees an average of 2.1 million users actively engaged. And over 1.75 million merchants using Shopify across 175 countries, resulting in a global economic contribution exceeding $444 billion.

With numerous quantity of fresh sellers and consumers who join the platform, it becomes increasingly valuable to provide an accessible and straightforward payment process for goods sold. Shopify addresses this need with its dedicated service, Shopify Payments.

Shopify Payments overview

Shopify includes its own payment system, known as Shopify Payments, which is crafted to make online payment acceptance more straightforward. With this system, sellers can bypass external transaction costs, optimize their checkout procedures, and oversee all financial transactions directly from their in-store dashboard. Additionally, this integrated payment processor ensures a more seamless and efficient shopping experience for customers, potentially boosting conversions.

Debuting in 2013, Shopify Payments has become an essential component of the Shopify infrastructure. Its evolution mirrors the overall growth and increasing market influence of Shopify. Initially crafted to provide a user-friendly payment solution, Shopify Payments has evolved significantly, enhancing its features to support a diverse array of sellers. It now offers multi-currency support and various payment options, highlighting Shopify's commitment to a secure and all-encompassing online shopping experience. As Shopify's reach extended globally, Shopify Payments evolved accordingly to fulfill the requirements of an international audience.

Starting its journey in 2004 under the name Snowdevil, Shopify has transformed into a leading e-commerce platform. A pivotal development came in 2013 with the debut of Shopify Payments. This functionality was added to incorporate payment handling directly into the Shopify platform, streamlining the payment experience for sellers and eliminating the need for external gateways. The smooth integration provided by Shopify Payments enhanced operational efficiency and lowered transaction fees for merchants utilizing the service, offering an economical alternative to other payment processing methods.

In 2016, Shopify unveiled Shopify Capital, a service that offers merchants cash advances using their forecasted sales through Shopify Payments. This program was designed to stimulate business expansion by avoiding the obstacles of standard loan procedures. In the subsequent year, 2017, Shopify rolled out a new feature called Shopify Pay, later rebranded as Shop Pay. This utility enabled customers to store their payment and shipping details, greatly accelerating the checkout experience for returning shoppers on any Shopify-supported store..

The international expansion of Shopify Payments has introduced compatibility with a wide range of currencies and geographic areas, meeting the varied demands of Shopify's worldwide merchant community. Currently, it accommodates over 130 different currencies and is accessible in multiple countries, easing the process of global selling for merchants. Moreover, alliances with payment platforms like Alipay have enabled seamless cross-border payments, further supporting Shopify merchants in their global business endeavors.

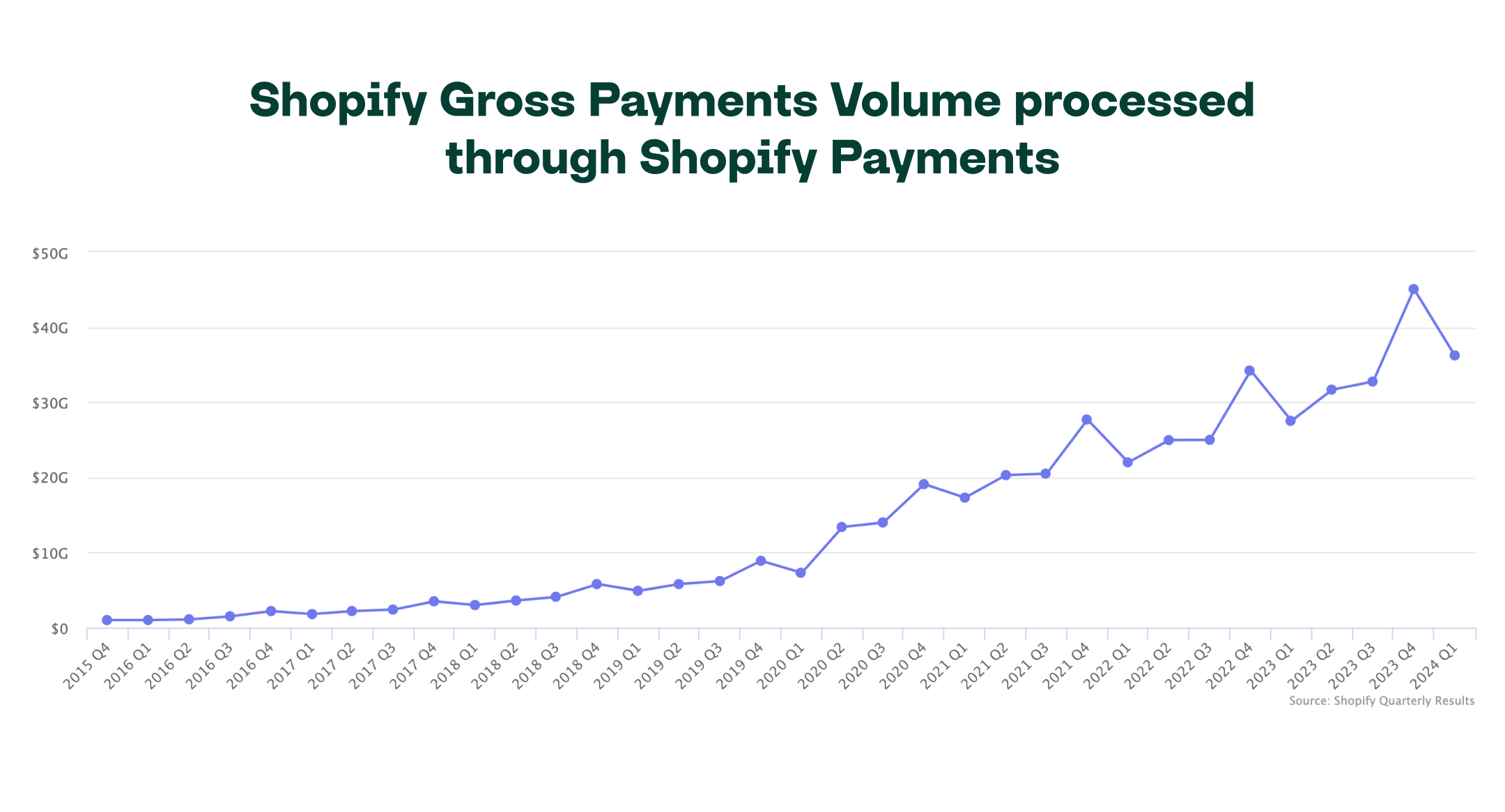

During Q4 2023, Shopify Payments processed close to $27.52 billion in gross merchandise volume. This amount surged by 32% to $36.24 billion in Q1 2024, reflecting robust year-over-year growth. These figures demonstrate Shopify's growing efficiency in facilitating online transactions.

Main features of Shopify Payments

In essence, Shopify Payments streamlines transactions for businesses and their clients by offering an extensive array of payment choices and effortless integration.

Regional Shopify Payments availability

Shopify Payments is accessible exclusively to stores operating within designated countries and regions.

- Denmark

- Spain

- United Kingdom

- France

- Germany

- Switzerland

- Sweden

- Italy

- Japan

- Finland

- United States

- Belgium

- New Zealand

- Portugal

- Czechia

- Austria

- Canada

- Netherlands

- Singapore

- Hong Kong SAR

- Romania

- Australia

- United States

- Ireland

Variety of payment methods support

Shopify Payments offers significant advantages by eliminating additional fees from external transactions made through its platform. By integrating seamlessly with Shopify's checkout tool, Shop Pay, this feature not only cuts expenses for merchants but also boosts efficiency. It allows customers to effortlessly save their payment and shipping details, simplifying future transactions.

Shopify Payments ensures broad compatibility with a wide array of payment options, encompassing major credit cards like Visa/Mastercard/American Express. It seamlessly integrates with popular digital wallets such as Apple Pay/Google Pay. Additionally, Shopify Payments supports Buy Now, Pay Later options by collaborating with partners. One of its partners for such solution is Klarna.

Merchants seeking enhanced payment flexibility can rely on Shopify Payments, which supports a variety of regional payment methods specific to customers' locations. These include Sofort and SEPA Direct Debit across Europe, iDEAL in the Netherlands, and Bancontact in Belgium. Offering these localized payment options not only facilitates international expansion for merchants but also enhances customer satisfaction by catering to diverse preferences.

Shopify Payments also accommodates over 130 different currencies, making it possible for merchants to conduct business with customers from all corners of the world. This versatility makes it particularly advantageous for international sellers aiming to offer localized payment solutions. Allowing customers to pay in their preferred currency reduces obstacles and has the potential to improve conversion rates significantly.

Fraud analysis

Shopify Payments provides merchants with sophisticated tools for detecting and preventing fraud. These tools analyze and correlate data throughout the entire shopping journey, starting from the initial cart creation to handling chargebacks, effectively identifying fraudulent patterns.

Employing advanced machine learning techniques, Shopify analyzes billions of transactions to detect and flag suspicious activities. By assessing variables like IP addresses, payment details, and customer behaviors, these algorithms swiftly evaluate transaction risks. Continuously updated to thwart evolving fraud tactics, this dynamic system ensures merchants can securely process the majority of orders.

Upon flagging a transaction as potentially fraudulent, Shopify provides merchants with comprehensive fraud analysis indicators. These indicators, depicted through green, red, or grey icons, aid in identifying risky transactions by detailing outcomes like the success of Address Verification Service (AVS) checks and instances of using multiple credit cards per order. Armed with this information, merchants can choose to investigate further, cancel, or refund transactions deemed high-risk.

In enhancing fraud prevention measures, Shopify collaborates with external fraud detection applications and tools. This includes integrating features like 3D Secure authentication, proxy detection capabilities, and automated systems for managing disputes.

Pay periods and payouts

Shopify consolidates payout transactions into regular bulk transfers aligned with the designated pay period. This period spans from the customer's order placement to the funds' transfer to your bank account, varying depending on the country and payment method used. Generally, domestic credit card transactions feature a shorter pay period compared to international transactions.

Using Shopify Payments, funds are deposited automatically into the merchant's bank account according to their selected schedule, whether daily, weekly, or monthly. Merchants located in France do not have the flexibility to choose their deposit schedule.

Normally, transferring funds to a bank account takes approximately 2-3 business days. Yet, if the payout date falls on a weekend or holiday, processing will occur on the subsequent business day..

To modify the payout timetable, navigate to the Shopify admin and go to Settings > Payments > Manage > Payout schedule. Adjusting the schedule may delay certain payments, which will remain pending until the next payout date according to the newly selected schedule.

Payouts can be categorized into different statuses such as 'Paid', 'Failed', or 'In Transit'. When a payout shows as 'Paid', it means Shopify has successfully transferred the funds to your bank account, although they may still be awaiting bank processing. A 'Failed' status could occur due to incorrect bank details or insufficient funds. Shopify promptly notifies you of failed payouts via a notification banner, offering guidance to resolve any issues promptly.

If you experience payouts that are missing or delayed, Shopify advises waiting for up to 10 business days to account for potential delays in bank processing. If the payout remains unresolved after this period, contact Shopify support for further assistance.

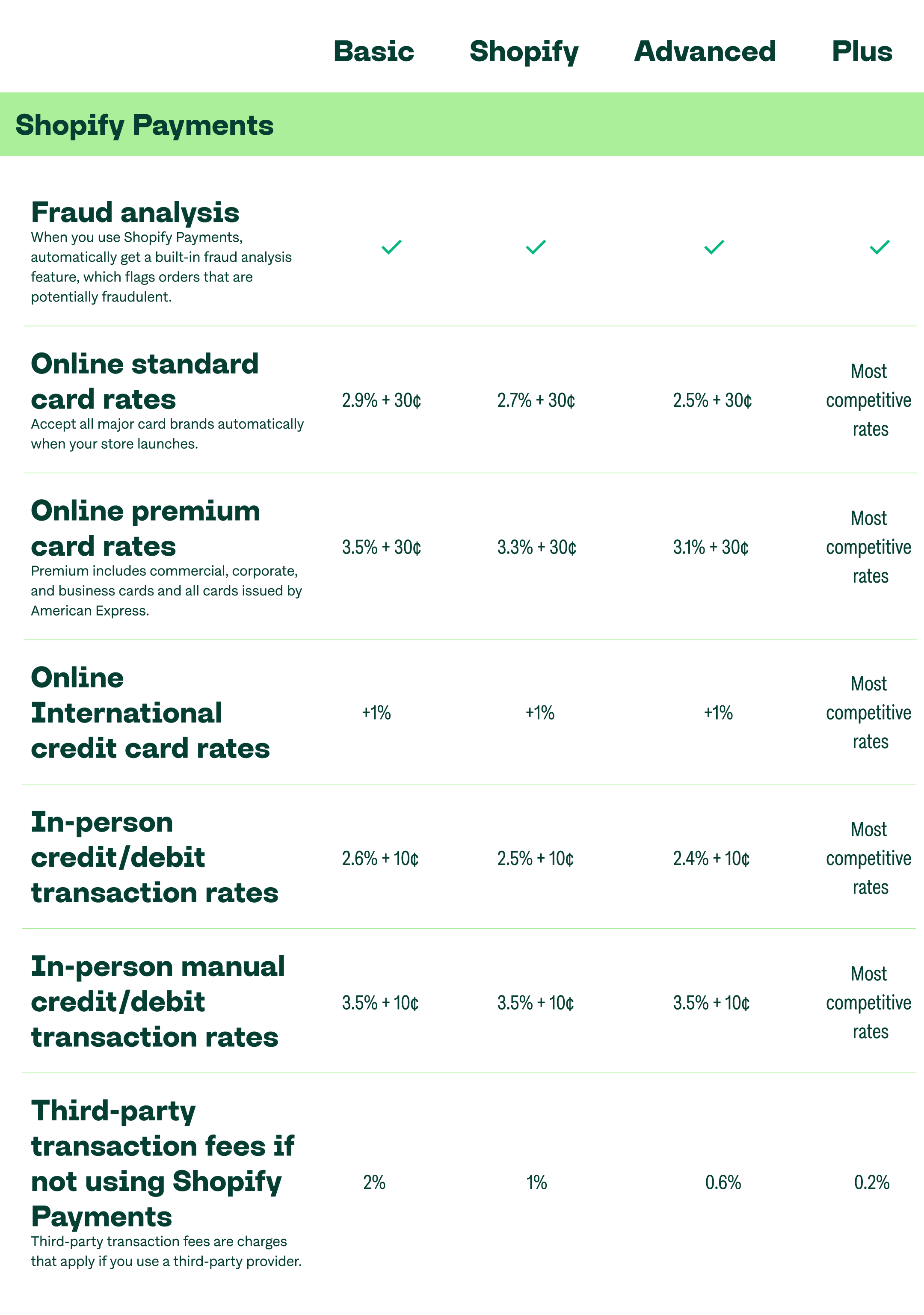

Shopify Payments fees

Shopify Payments simplifies financial transaction management and eliminates reliance on external payment gateways and their accompanying charges. Nonetheless, there are distinct fees linked to using Shopify Payments that merchants must take into account.

The fees for Shopify Payments depend on the store location and Shopify plan, and may fluctuate. The fee also varies depending on the credit card type and card registered location. Additionally, currency conversion fee is applied for transactions captured in a currency that is not a currency of payout.

Regardless of the country, if the store is on Shopify Plus plan, Shopify marks the Shopify Payments fees as competitive. Here is the example of Shopify Payments fees for stores based in USA:

- Basic

- Local credit card rates: 2.9% + 30Вў

- Amex credit card rates: 3.5% + 30Вў

- International credit card rates: + 1%

- In-person credit/debit transaction rates: 2.6% + 10Вў

- In-person manual credit/debit transaction rates: 3.5% + 10Вў

- Third-party transaction fees if not using Shopify Payments: 2%

- Shopify

- Local credit card rates: 2.7% + 30Вў

- Amex credit card rates: 3.3% + 30Вў

- International credit card rates: + 1%

- In-person credit/debit transaction rates: 2.5% + 10Вў

- In-person manual credit/debit transaction rates: 3.5% + 10Вў

- Third-party transaction fees if not using Shopify Payments: 1%

- Advanced

- Local credit card rates: 2.5% + 30Вў

- Amex credit card rates: 3.1% + 30Вў

- International credit card rates: + 1%

- In-person credit/debit transaction rates: 2.4% + 10Вў

- In-person manual credit/debit transaction rates: 3.5% + 10Вў

- Third-party transaction fees if not using Shopify Payments: 0.6%

- Plus

- Local credit card rates: Most competitive rates

- Amex credit card rates: Most competitive rates

- International credit card rates: Most competitive rates

- In-person credit/debit transaction rates: Most competitive rates

- In-person manual credit/debit transaction rates: Most competitive rates

- Third-party transaction fees if not using Shopify Payments: 0.2%

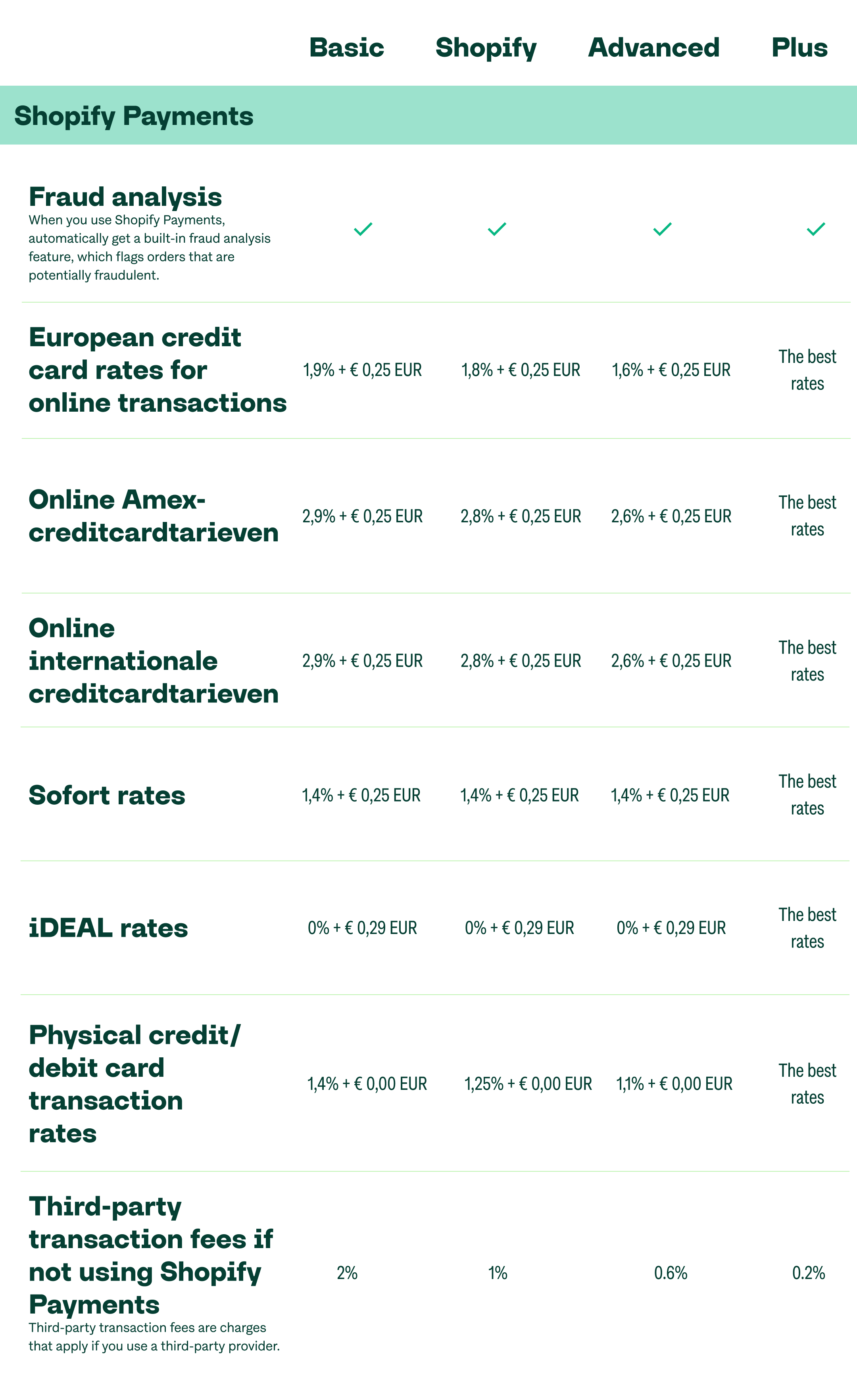

Here is an example of Shopify Payments fees for stores based in Netherlands:

- Basic: 1,9% + € 0,25 EUR

- Shopify: 1,8% + € 0,25 EUR

- Advanced: 1,6% + € 0,25 EUR

- Plus: The best rates

- Basic: 2,9% + € 0,25 EUR

- Shopify: 2,8% + € 0,25 EUR

- Advanced: 2,6% + € 0,25 EUR

- Plus: The best rates

- Basic: 2,9% + € 0,25 EUR

- Shopify: 2,8% + € 0,25 EUR

- Advanced: 2,6% + € 0,25 EUR

- Plus: The best rates

- Basic: 1,4% + € 0,25 EUR

- Shopify: 1,4% + € 0,25 EUR

- Advanced: 1,4% + € 0,25 EUR

- Plus: The best rates

- Basic: 0% + € 0,39 EUR

- Shopify: 0% + € 0,39 EUR

- Advanced: 0% + € 0,39 EUR

- Plus: The best rates

- Basic: 0% + € 0,29 EUR

- Shopify: 0% + € 0,29 EUR

- Advanced: 0% + € 0,29 EUR

- Plus: The best rates

- Basic: 1,4% + € 0,00 EUR

- Shopify: 1,25% + € 0,00 EUR

- Advanced: 1,1% + € 0,00 EUR

- Plus: The best rates

- Basic: 2%

- Shopify: 1%

- Advanced: 0,6%

- Plus: 0,2%

How to set up Shopify Payments

Setting up Shopify Payments for a store involves a straightforward configuration process. Here are the steps to get started:

Step 1: Open Shopify Payments Settings

- Sign in to your Shopify admin account.

- Go to the bottom left corner of your dashboard and select Settings.

- Choose Payments from the Settings menu.

Step 2: Activate Shopify Payments

- Within the Payments page, locate the Shopify Payments section.

- Select Complete account setup. If Shopify Payments isn't activated yet, you will find a Set up Shopify Payments option. Click it to start the setup process.

Step 3: Input Business Details

These details encompass:

- Business Type: Select your entity type, whether it's an individual, sole proprietorship, or registered company.

- Business Information: Enter your business address, contact number, and business registration number if applicable.

- Personal Information: Provide details about the business owner, including their name, birth date, and the last four digits of their Social Security Number (for businesses based in the US).

Step 4: Input Banking Details

Provide your banking information to receive payouts. This involves:

- Routing Number: Input the routing number associated with your bank.

- Account Number: Enter your bank account number.

- Account Type: Specify whether the account is checking or savings.

Step 5: Confirm Identity

Shopify might need to verify the owner's identity. This procedure includes submitting a photo ID (like a driver’s license or passport) and possibly other documents.

Step 6: Finalize

- Double-check all entered information to ensure accuracy.

- Click on Finish setup to complete the process.

Step 7: Set Up Payment Options

- After activating Shopify Payments, customize the payment methods you wish to use, including credit cards, Apple Pay, and Google Pay.

- In the Payments settings, adjust the toggles for each payment method to activate or deactivate them as needed.

US-based sellers must provide tax details, including either their Employer Identification Number (EIN) or Social Security Number (SSN).

For stores selling in multiple currencies, there's an option to set up multi-currency support in Shopify Payments settings. This includes adding desired currencies and customizing rounding rules and display preferences.

Alternatives to Shopify Payments

Occasionally, certain Shopify stores may not meet the eligibility criteria for using Shopify Payments. In such instances, store owners may explore alternative payment solutions. These alternatives offer diverse features tailored to various business requirements, spanning user-friendliness, customer recognition, seamless integration, and global functionality.

Renowned for its intuitive interface, diverse payment methods, global accessibility, and robust security measures, PayPal is a highly regarded payment platform. Its widespread use among consumers and businesses alike contributes to increased checkout completion rates, bolstered by its trusted reputation and widespread familiarity.

Stripe, known for its extensive array of features, is another popular option among businesses. It facilitates multiple payment methods such as credit cards, debit cards, digital wallets, and even cryptocurrency. Stripe's customizable and scalable nature makes it particularly suitable for businesses aiming for international growth.

For businesses engaging in global transactions, WorldPay proves ideal. It provides comprehensive backing for numerous currencies and payment modes, along with robust security features and customizable functionalities. WorldPay's extensive global presence positions it as a formidable choice for businesses seeking international market expansion.

Square Online presents a compelling choice for businesses that already utilize Square's POS systems. It seamlessly integrates offline and online sales, making it convenient for small businesses operating on a tight budget with its free plan. Additionally, Square facilitates multichannel selling, extending to platforms such as Facebook and Instagram.

Adyen stands out as a formidable option, particularly suitable for large enterprises. It enables omnichannel sales and offers a wide range of payment options, making it well-suited for managing subscriptions and global payments. Adyen's AI-driven risk assessment and comprehensive customer support further enhance its attractiveness to businesses seeking robust fraud prevention and scalable payment solutions.

Choosing the best payment gateway

When selecting a payment gateway, consider these key factors:

- Evaluate transaction costs to understand financial impact.

- Ensure compatibility with preferred customer payment methods.

- Choose a gateway that integrates smoothly with Shopify.

- Assess checkout processes to optimize conversion rates.

- Verify compliance with industry security standards like PCI.

Consider these factors alongside Shopify Payments' fees, features, and alternatives to tailor your choice to meet business needs and enhance the shopping experience for customers.

Summarizing

Deciding on the best payment gateway for a business is a pivotal decision affecting its operations, customer satisfaction, and overall trajectory of growth. Key factors to consider include transaction fees, accepted payment methods, security features, and ease of integration.

From the array of choices, Shopify Payments shines brightly, particularly for Shopify store operators, thanks to its effortless integration and comprehensive capabilities. Serving as Shopify's default gateway, Shopify Payments provides a unified solution that streamlines payment procedures. One of its notable strengths lies in managing diverse currencies (over 130) and accommodating various payment modes like credit cards, digital wallets, and buy-now-pay-later alternatives. Moreover, this gateway boasts competitive processing rates.

Yet, it's crucial to explore alternative options like PayPal, Stripe, and WorldPay to ensure a well-informed choice.

In the end, a selection of a payment gateway should match business's distinct objectives and requirements. Whether the manager emphasizes cost-effectiveness, payment variety, security, ease of integration, or customer service, a thorough assessment of these aspects will guide toward choosing the optimal payment gateway. This ensures seamless and secure transactions for customers.